At the request of community users who want to have a multi-variety double-EMA strategy for design reference. In this article, we will implement a multi-variety double-EMA strategy. Comments will be written on the strategy code to for convenient understanding and learning. Let more newcomers of programming and quantitative trading get a quick start.

Strategy ideas

The logic of the double-EMA strategy is very simple, that is, two EMAs. An EMA (fast line) with a small parameter period and an EMA (slow line) with a large parameter period. If the two lines have a golden cross (the fast line goes through the slow line from the bottom to the top), then we buy and go long; and if the two lines have a dead cross (the fast line goes through the slow line from the top to the bottom), then we sell and go short. We use EMA here.

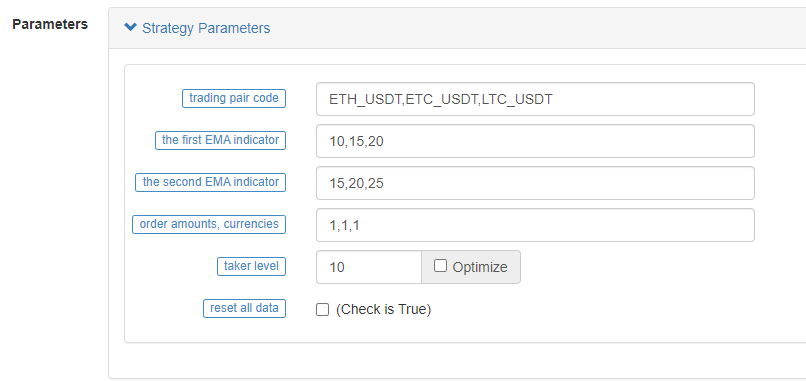

However, the strategy should be designed as multi-variety, so the parameters of each variety may be different (different varieties use different EMA parameters), so a "parameter group" method should be used to design parameters.

The parameters are designed in the string form, with each parameter comma separated. Parse these strings when the strategy starts running. The execution logic match to each variety (trading pair). The strategy rotated detects the market of each variety, the triggering of trading conditions, chart printing, etc. After all varieties are rotated once, summarize the data and display the table information on the status bar.

The strategy is designed to be very simple and suitable for newcomers' learning, with only 200+ lines of code in total.

Strategy code

javascript// Function: cancel all takers of the current trading pair

function cancelAll(e) {

while (true) {

var orders = _C(e.GetOrders)

if (orders.length == 0) {

break

} else {

for (var i = 0 ; i < orders.length ; i++) {

e.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// Functionn: calculate the profit/loss in real-time

function getProfit(account, initAccount, lastPrices) {

// account is the current account information, initAccount is the initial account information, lastPrices is the latest price of all varieties

var sum = 0

_.each(account, function(val, key) {

// Iterate through all current assets, calculate the currency difference of assets other than USDT, and the amount difference

if (key != "USDT" && typeof(initAccount[key]) == "number" && lastPrices[key + "_USDT"]) {

sum += (account[key] - initAccount[key]) * lastPrices[key + "_USDT"]

}

})

// Return to the profit and loss of the asset based on the current prices

return account["USDT"] - initAccount["USDT"] + sum

}

// Function: generate chart configuration

function createChartConfig(symbol, ema1Period, ema2Period) {

// symbol is the trading pair, ema1Period is the first EMA period, ema2Period is the second EMA period

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K-line data series

name: symbol,

id: symbol,

data: []

}, {

type: 'line', // EMA data series

name: symbol + ',EMA1:' + ema1Period,

data: [],

}, {

type: 'line', // EMA data series

name: symbol + ',EMA2:' + ema2Period,

data: []

}

]

}

return chart

}

function main() {

// Reset all data

if (isReset) {

_G(null) // Clear data of all persistent records

LogReset(1) // Clear all logs

LogProfitReset() // Clear all return logs

LogVacuum() //Release the resources occupied by the real bot database

Log("Reset all data", "#FF0000") // Print messages

}

// Parameter analysis

var arrSymbols = symbols.split(",") // Comma-separated string of trading varieties

var arrEma1Periods = ema1Periods.split(",") // Parameter string for splitting the first EMA

var arrEma2Periods = ema2Periods.split(",") // Parameter string for splitting the second EMA

var arrAmounts = orderAmounts.split(",") // Splitting the amount of orders placed for each variety

var account = {} // Variables used for recording current asset messages

var initAccount = {} // Variables used for recording initial asset messages

var currTradeMsg = {} // Variables used for recording whether current BAR trades

var lastPrices = {} // Variables used for recording the latest price of monitored varieties

var lastBarTime = {} // Variable used for recording the time of the last BAR, used to judge the update of BAR when drawing

var arrChartConfig = [] // Used for recording chart configuration message and draw

if (_G("currTradeMsg")) { // For example, restore currTradeMsg data when restarting

currTradeMsg = _G("currTradeMsg")

Log("Restore records", currTradeMsg)

}

// Initialize account

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol)

var arrCurrencyName = symbol.split("_")

var baseCurrency = arrCurrencyName[0]

var quoteCurrency = arrCurrencyName[1]

if (quoteCurrency != "USDT") {

throw "only support quoteCurrency: USDT"

}

if (!account[baseCurrency] || !account[quoteCurrency]) {

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

}

// Initialize chart-related data

lastBarTime[symbol] = 0

arrChartConfig.push(createChartConfig(symbol, arrEma1Periods[index], arrEma2Periods[index]))

})

if (_G("initAccount")) {

initAccount = _G("initAccount")

Log("Restore initial account records", initAccount)

} else {

// Initialize the initAccount variable with the current asset information

_.each(account, function(val, key) {

initAccount[key] = val

})

}

Log("account:", account, "initAccount:", initAccount) // Print asset information

// Initialize the chart object

var chart = Chart(arrChartConfig)

// Chart reset

chart.reset()

// Strategy main loop logic

while (true) {

// Iterate through all varieties and execute the double-EMA logic one by one

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol) // Switch the trading pair to the trading pair of symbol string record

var arrCurrencyName = symbol.split("_") // Split the trading pairs with the "_" symbol

var baseCurrency = arrCurrencyName[0] // String for trading currencies

var quoteCurrency = arrCurrencyName[1] // String for denominated currency

// Obtain the EMA parameters of the current trading pair according to the index

var ema1Period = parseFloat(arrEma1Periods[index])

var ema2Period = parseFloat(arrEma2Periods[index])

var amount = parseFloat(arrAmounts[index])

// Obtain the K-line data of the current trading pair

var r = exchange.GetRecords()

if (!r || r.length < Math.max(ema1Period, ema2Period)) { // Return directly if K-line length is insufficient

Sleep(1000)

return

}

var currBarTime = r[r.length - 1].Time // Record the current BAR timestamp

lastPrices[symbol] = r[r.length - 1].Close // Record the latest current price

var ema1 = TA.EMA(r, ema1Period) // Calculate EMA indicators

var ema2 = TA.EMA(r, ema2Period) // Calculate EMA indicators

if (ema1.length < 3 || ema2.length < 3) { // The length of EMA indicator array is too short, return directly

Sleep(1000)

return

}

var ema1Last2 = ema1[ema1.length - 2] // EMA on the penultimate BAR

var ema1Last3 = ema1[ema1.length - 3] // EMA on the third from the last BAR

var ema2Last2 = ema2[ema2.length - 2]

var ema2Last3 = ema2[ema2.length - 3]

// Write data to the chart

var klineIndex = index + 2 * index

// Iterate through the K-line data

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == lastBarTime[symbol]) { // Draw the chart, update the current BAR and indicators

// update

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

chart.add(klineIndex + 1, [r[i].Time, ema1[i]], -1)

chart.add(klineIndex + 2, [r[i].Time, ema2[i]], -1)

} else if (r[i].Time > lastBarTime[symbol]) { // Draw the charts, add BARs and indicators

// add

lastBarTime[symbol] = r[i].Time // Update timestamp

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

chart.add(klineIndex + 1, [r[i].Time, ema1[i]])

chart.add(klineIndex + 2, [r[i].Time, ema2[i]])

}

}

if (ema1Last3 < ema2Last3 && ema1Last2 > ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// Golden cross

var depth = exchange.GetDepth() // Obtain the depth data of current order book

var price = depth.Asks[Math.min(takeLevel, depth.Asks.length)].Price // Take the 10th grade price, taker

if (depth && price * amount <= account[quoteCurrency]) { // Obtain deep data normally with enough assets to place an order

exchange.Buy(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2) // Place a buy order

cancelAll(exchange) // Cancel all makers

var acc = _C(exchange.GetAccount) // Obtain account asset information

if (acc.Stocks != account[baseCurrency]) { // Detect changes in account assets

account[baseCurrency] = acc.Stocks // Update assets

account[quoteCurrency] = acc.Balance // Update assets

currTradeMsg[symbol] = currBarTime // Record that the current BAR has been traded

_G("currTradeMsg", currTradeMsg) // Persistent records

var profit = getProfit(account, initAccount, lastPrices) // Calculate profits

if (profit) {

LogProfit(profit, account, initAccount) // Print profits

}

}

}

} else if (ema1Last3 > ema2Last3 && ema1Last2 < ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// dead cross

var depth = exchange.GetDepth()

var price = depth.Bids[Math.min(takeLevel, depth.Bids.length)].Price

if (depth && amount <= account[baseCurrency]) {

exchange.Sell(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2)

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

if (acc.Stocks != account[baseCurrency]) {

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

currTradeMsg[symbol] = currBarTime

_G("currTradeMsg", currTradeMsg)

var profit = getProfit(account, initAccount, lastPrices)

if (profit) {

LogProfit(profit, account, initAccount)

}

}

}

}

Sleep(1000)

})

// Table variables in the status bar

var tbl = {

type : "table",

title : "Account Information",

cols : [],

rows : []

}

// Write data into the status bar table structure

tbl.cols.push("--")

tbl.rows.push(["initial"])

tbl.rows.push(["current"])

_.each(account, function(val, key) {

if (typeof(initAccount[key]) == "number") {

tbl.cols.push(key)

tbl.rows[0].push(initAccount[key]) // initial

tbl.rows[1].push(val) // current

}

})

// Show status bar table

LogStatus(_D(), "\n", "profit:", getProfit(account, initAccount, lastPrices), "\n", "`" + JSON.stringify(tbl) + "`")

}

}

Strategy backtest

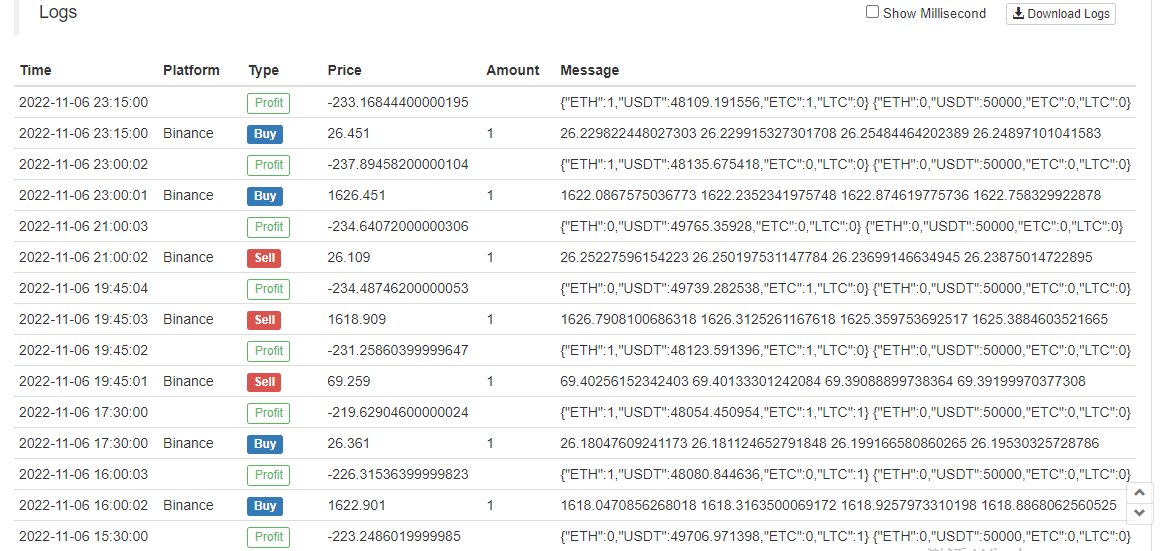

It can be seen that ETH, LTC and ETC are triggered according to the Golden Cross and Dead Cross of EMA, and tradings have occurred.

We can also take a simulation bot for testing.

Strategy source code: https://www.fmz.com/strategy/333783

The strategy is used for backtesting, learning strategy design only, and it should be used with caution in the real bot.