Preliminary Study on Backtesting of Digital Currency Options Strategy

Recently, FMZ Platform has upgraded the backtesting system to support the backtesting of digital currency options. This time, it supports some option data of the Deribit exchange. So we have better tools for option trading learning and strategy verification.

Deribit options backtest

The Deribit option defined in the backtest system is European style, and the value of one contract is 1BTC. The option contract code is: BTC-7AUG20-12750-C.

| Subject | Exercise Date | Exercise Price | (Call/Put) Option |

| BTC | 7AUG20 | 12750 | C |

| Bitcoin | Exercise on August 7, 2020 | Exercise price 12750 | Call options |

| BTC | 7AUG20 | 12750 | P |

| Bitcoin | Exercise on August 7, 2020 | Exercise price 12750 | Put option |

Operations such as setting contracts and obtaining positions are the same as digital currency futures.

Set contract: exchange.SetContractType("BTC-7AUG20-12750-C")

Get position: var pos = exchange.GetPosition()

The price of an option contract is the premium of an option contract, and the option buyer needs to pay the option premium to the option seller. The buyer has the right to exercise, and the seller has the obligation to exercise. Before the option contract is exercised, it can be traded (such as liquidation, settlement of obligations).

Examples of common option trading combinations

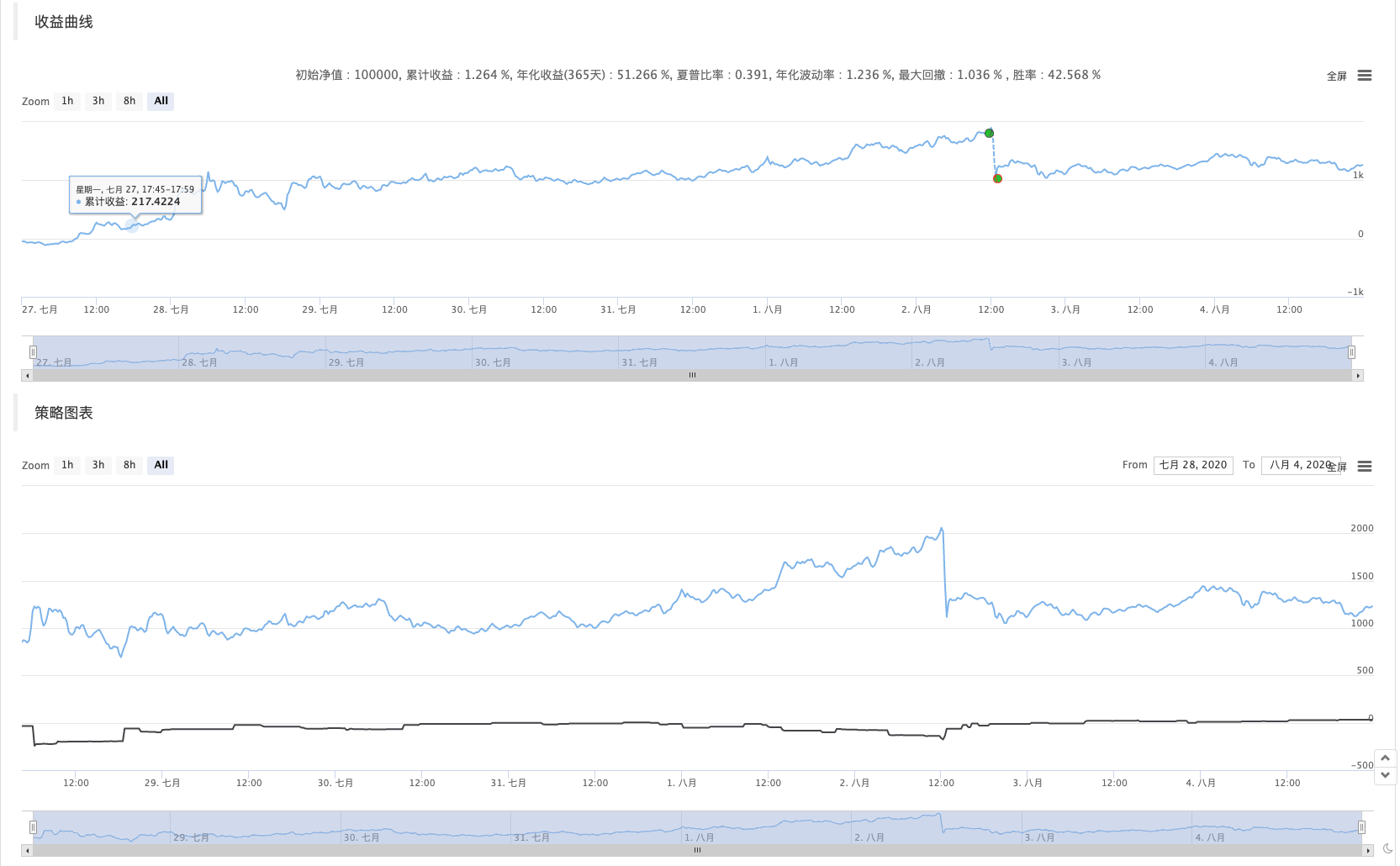

Sell a call option and buy a spot.

/*backtest

start: 2020-07-27 00:00:00

end: 2020-08-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Deribit","currency":"BTC_USD"},{"eid":"OKEX","currency":"BTC_USDT","balance":100000}]

*/

function main() {

exchanges[0].SetContractType('BTC-7AUG20-12750-C');

var initSpotAcc = _C(exchanges[1].GetAccount)

var isFirst = true

while(true) {

var optionTicker = exchanges[0].GetTicker()

var spotTicker = exchanges[1].GetTicker()

if(isFirst) {

exchanges[0].SetDirection("sell")

exchanges[0].Sell(optionTicker.Buy, 1)

exchanges[1].Buy(spotTicker.Sell, 1)

isFirst = false

}

var optionPos = _C(exchanges[0].GetPosition)

var nowSpotAcc = _C(exchanges[1].GetAccount)

var diffStocks = (nowSpotAcc.Stocks - initSpotAcc.Stocks)

var diffBalance = (nowSpotAcc.Balance - initSpotAcc.Balance)

var spotProfit = diffBalance + diffStocks * spotTicker.Last

var optionProfit = optionPos[0].Profit * spotTicker.Last

LogProfit(spotProfit + optionProfit)

$.PlotLine("Spots", spotProfit)

$.PlotLine("Options", optionProfit)

Sleep(500)

}

}

Options can provide a certain degree of hedging protection to the assets purchased in spot. Generally used when optimistic about the spot and willing to hold the spot. The risk lies in the drop in spot prices. Although to a certain extent, options can make up for a certain spot loss, but after the loss exceeds the option premium, there will be a net loss.

In addition, the liquidity of the digital currency options market is average, and sometimes no counterparty is found. This is also an issue that needs to be considered.

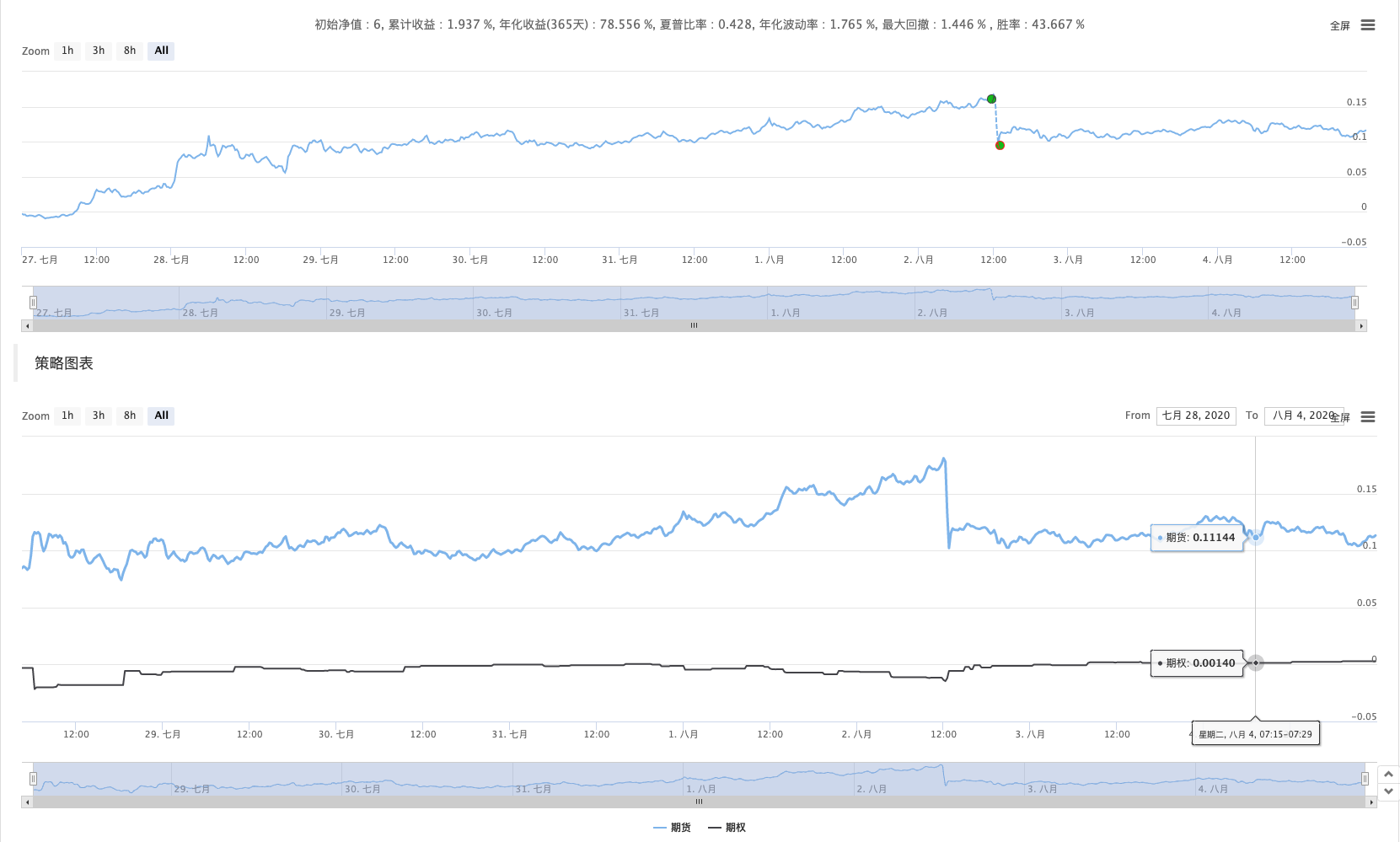

Similarly, we can replace spot with futures, the code is as follows:

/*backtest

start: 2020-07-27 00:00:00

end: 2020-08-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Deribit","currency":"BTC_USD"},{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

*/

function main() {

exchanges[0].SetContractType('BTC-7AUG20-12750-C');

exchanges[1].SetContractType("quarter")

var isFirst = true

while(true) {

var optionTicker = exchanges[0].GetTicker()

var futuresTicker = exchanges[1].GetTicker()

if(isFirst) {

exchanges[0].SetDirection("sell")

exchanges[0].Sell(optionTicker.Buy, 1)

exchanges[1].SetDirection("buy")

exchanges[1].Buy(futuresTicker.Sell, _N(1 * futuresTicker.Sell / 100, 0))

isFirst = false

}

var optionPos = _C(exchanges[0].GetPosition)

var futuresPos = _C(exchanges[1].GetPosition)

var futuresProfit = futuresPos[0].Profit

var optionProfit = optionPos[0].Profit

LogProfit(futuresProfit + optionProfit)

$.PlotLine("Futures", futuresProfit)

$.PlotLine("Options", optionProfit)

Sleep(500)

}

}

Futures can reduce the capital occupied than spot, but the risk is higher than that of spot.

In addition, there are many other options trading combinations:

Bull call option spread

bull call spreadBear Put option Spread

Bear Put Spread

Those who are interested can study it in the backtest system.

From: Preliminary Study on Backtesting of Digital Currency Options Strategy (fmz.com)